Rural Spending Rises by 35 per cent, Outperforming Urban and Metro Areas in 2024 Festival Expenditure

Hyderabad (Telangana) [India], October 23: Rural consumers are significantly shaping the festive spending landscape this year, with a remarkable 35 per cent increase in their spending. This surge underscores the growing purchasing power of rural India, highlighting its vital role in driving overall consumption growth.

The Fast-Evolving Rural Consumer

According to a comprehensive report from InsightCrunch, based on 4500+ in-depth interviews across 16 states, India is witnessing a surge in spending, highlighting growing consumer confidence nationwide. The increases vary across regions: Rural consumers have an average expenditure of Rs. 15,119, reflecting a significant increase of 35% from the last year. In Urban areas, the average spend rises to Rs. 18,317, marking a 30% increase, while Metro residents spend an average of Rs. 21,151, which represents a YoY growth of 33%. Although Metro residents outspend their rural counterparts by approximately 40% more per capita, the faster growth in rural spending indicates a noteworthy shift.

“The rise in rural spending is a testament to the evolving economic landscape in India. The untapped potential in rural markets is being realised this festive season,” says Deekshith Vemuganti, CEO of InsightCrunch.

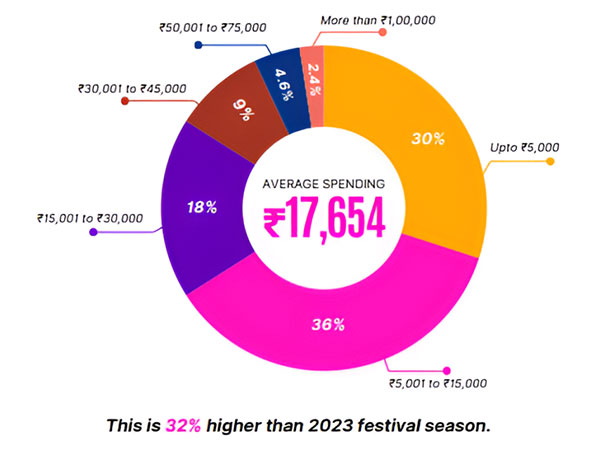

While average overall spending per capita stands at Rs. 17,654, almost one-third of the population will be spending under Rs 5000, and another one third between Rs. 5000 and Rs. 15000. Overall, the spending shows an uptick of 32% from the previous year.

How are they funding it?

Fueled by confidence in the Indian economy, 65% of consumers are happy to tap into their savings to amp up the festival fun. Middle-income households, under spending pressure and limited funding options, are 3 times more likely than lower-income groups to rely on bank loans for festival expenses.

“This data provides valuable insights for financial institutions, retailers, and FMCG companies to tailor their festival season offerings and marketing strategies, particularly focusing on middle-income consumers who show a higher propensity for credit-based spending.,” adds Sudhanshu Gupta, VP of InsightCrunch.

Head over to this link if you want free access to the entire report.

About the Company:

InsightCrunch has conducted over 2,250 surveys and has collected 9 crore+ (90 Million+) data points, a comprehensive and reliable basis for analysing trends and behaviours. Through its robust data collection and analytical capabilities, InsightCrunch provides invaluable insights into how various demographics engage with technology.

Please feel free to contact us for more information: Mobile: +91-9160638589, Mail: insights@vedavaag.com